The T100 ‘JET’ Risk Engine

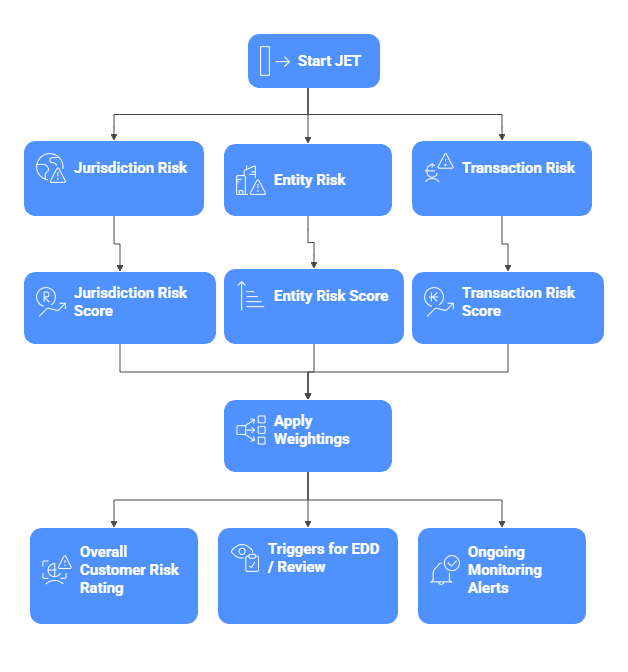

The T100 JET Risk Engine is a standout feature of the T100 platform. JET is an acronym representing the three core dimensions of risk it evaluates: Jurisdiction, Entity, and Transaction. Rather than relying on a single, static risk score, JET applies a dynamic, multi-dimensional approach that delivers deeper, more actionable insights. Below is a breakdown of how it works.

J – Jurisdiction Risk: Assesses where risk originates by cross-referencing client operations, director locations, and bank domiciles against leading global indices, including FATF (Financial Action Task Force) mutual evaluations, Transparency International’s Corruption Perceptions Index, and the Basel AML Index.

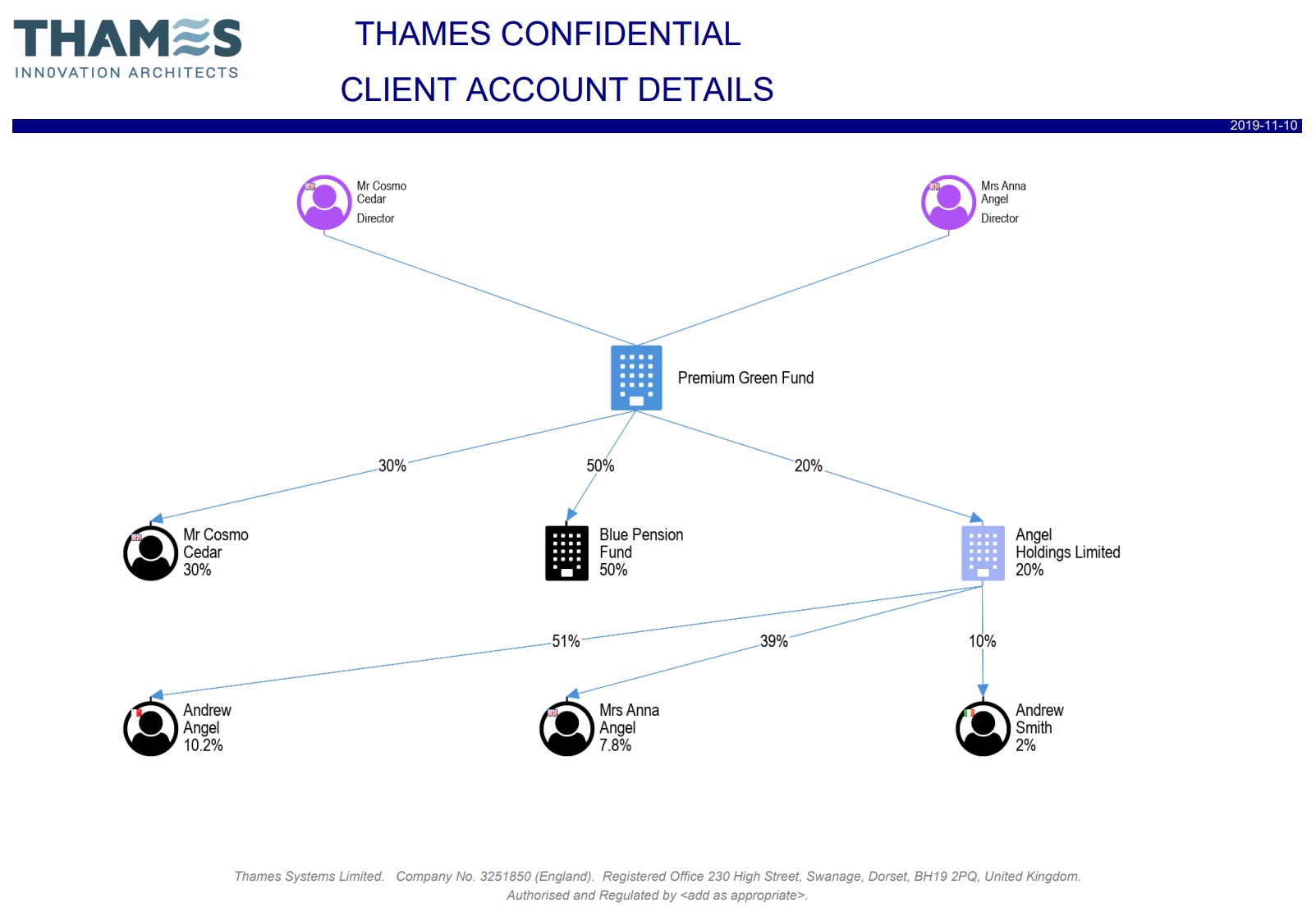

E – Entity Risk: Analyzes who you are dealing with. It looks at legal structures (trusts, charities, etc.), ownership complexity (layers between the business and UBOs), regulatory status, and industry sectors (SIC/NACE codes) to flag high-risk areas like crypto or gambling.

T – Transaction Risk: Monitors behavior. This is the most dynamic part, analyzing the value, velocity, and cross-border flow of funds. It runs automated checks every morning to scan for anomalies and uses a “traffic-light” system to flag suspicious spikes.

Comprehensive Risk Scoring for Modern Compliance

Transforming data into actionable risk intelligence

The JET Risk Engine is a core component of the T100 platform. Instead of merely recording information, it actively monitors and interprets it. In the broader T100 suite the system continuously checks live data, turning compliance from a reactive duty into a proactive defence mechanism.

It uses external financial and geopolitical data – such as FATF grey/black lists, Corruption Perception Index (CPI) and Basel compliance indexes – to compute transparent risk ratings. This intelligence is delivered through an auditable workflow that ensures your firm is always prepared for regulatory scrutiny

Real‑time risk scoring

Configurable weighting model

Transparent audit trail

Automated alerts & escalation

Legal structure

Capture corporate, trust or partnership types and assess inherent risk.

Ownership complexity

Rate the number of entities between the business and its UBOs.

Regulatory status

Determine if the firm is regulated and by whom; unregulated firms often carry more risk.

Industry & sector risk

Use official codes to detect high‑risk industries and PEP involvement.

Why T100 with JET

Real‑time intelligence

Live data feeds and automated checks ensure risks are caught early.

Audit‑ready transparency

Every score has a clear rationale.

Seamless integration

JET feeds risk intelligence into the T100 CRM and the Core Monitoring and Alerting tools.

Customisable to your business

Adjust weightings and thresholds to align with your policies and risk appetite.

Jurisdiction risk: know where risk originates

JET evaluates where your client operates, where directors and beneficial owners are located, and where accounts are held. It draws on external indices (FATF lists, CPI, Basel scores) to identify high‑risk jurisdictions and produce a jurisdiction risk score. Factors considered include head‑office and operating countries, UBO residences, bank domiciles and sanctions exposure.

Entity risk: assess who you’re dealing with

JET looks beyond the client’s address to examine what kind of business you’re onboarding. It identifies the legal structure (company, partnership, trust, charity), evaluates how many layers separate the firm from its ultimate owners and determines whether the business is regulated.

Industry classification codes (SIC/NACE) reveal whether the entity operates in high‑risk sectors like crypto, gambling or money service businesses, and any involvement of politically exposed persons (PEPs) is captured in the entity risk score.

Transaction risk: understand client behaviour

Transaction patterns often reveal more about a client than their corporate paperwork. JET analyses the value and velocity of funds moving through accounts, cross‑border flows, markets and counterparties, and the types of products and channels used.

The system performs automated consistency checks every morning, scanning transaction and account data for anomalies. When an irregularity is found, JET triggers an alert and categorises it via a traffic‑light system. This generates a transaction risk score that captures both routine behaviour and suspicious spikes.

Key Factors

- Volumes & velocity – track how much money moves and how quickly.

- Markets & counterparties – monitor which counterpartiesexchanges or partners are involved and whether they are reputable

- Cross‑border flows – flag transactions through high‑risk or sanctioned countries.

- Product & channel risk – identify risky instruments or payment channels that might facilitate money laundering.

Combining the scores: your overall risk rating

Each dimension above is scored independently and then combined into a single customer risk rating. You can configure the weighting for jurisdiction, entity and transaction scores to reflect your firm’s risk appetite.

For example, a balanced model might weight jurisdiction at 40 %, entity at 30 % and transaction at 30 %. JET applies these weightings and produces a transparent overall risk rating.

When the combined score exceeds defined thresholds, JET automatically triggers Enhanced Due Diligence (EDD) workflows and ongoing monitoring alerts. This ensures that higher‑risk customers are escalated promptly while lower‑risk clients proceed smoothly.