Customer Portal

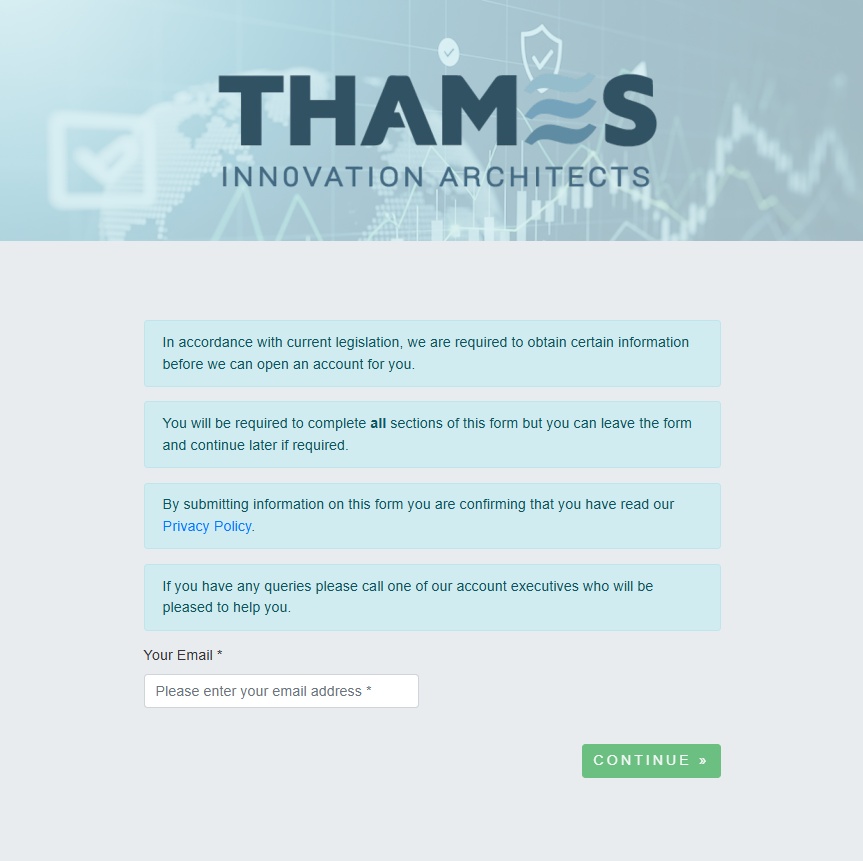

The T100 Customer Portal acts as the secure, digital front door for your firm, replacing complex paperwork with an intuitive electronic experience.

Accelerate client onboarding, enhance data quality, and make compliance seamless, for both you and your customers.

Fast-Track Client Onboarding

A fully integrated onboarding experience for regulated financial firms

The T100 Customer Portal is tightly integrated with T100 Core and CRM, providing a secure, highly configurable onboarding experience for regulated financial firms. It replaces fragmented paper processes with structured digital workflows that adapt to your regulatory obligations today and tomorrow.

Built specifically for FSMA firms, FX brokers and payment services providers, the portal allows you to design onboarding journeys that reflect how your business actually operates.

Feature Highlights

Fast track onboarding

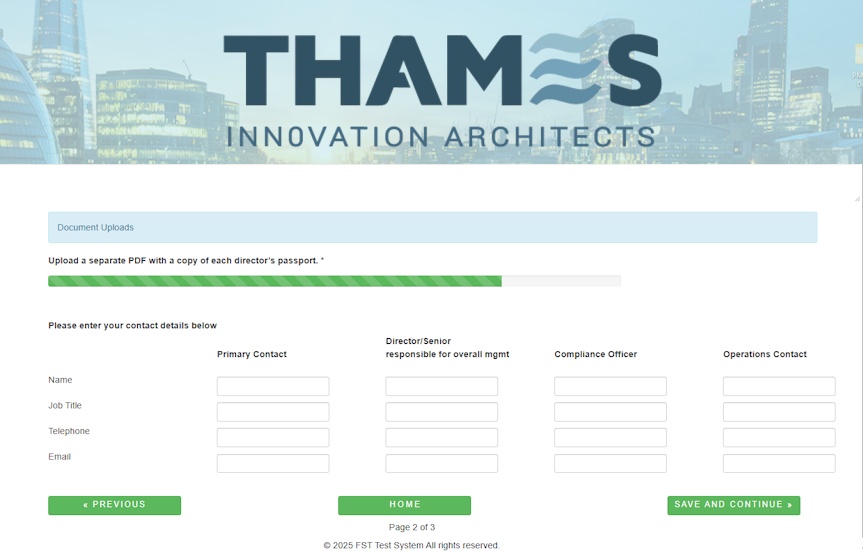

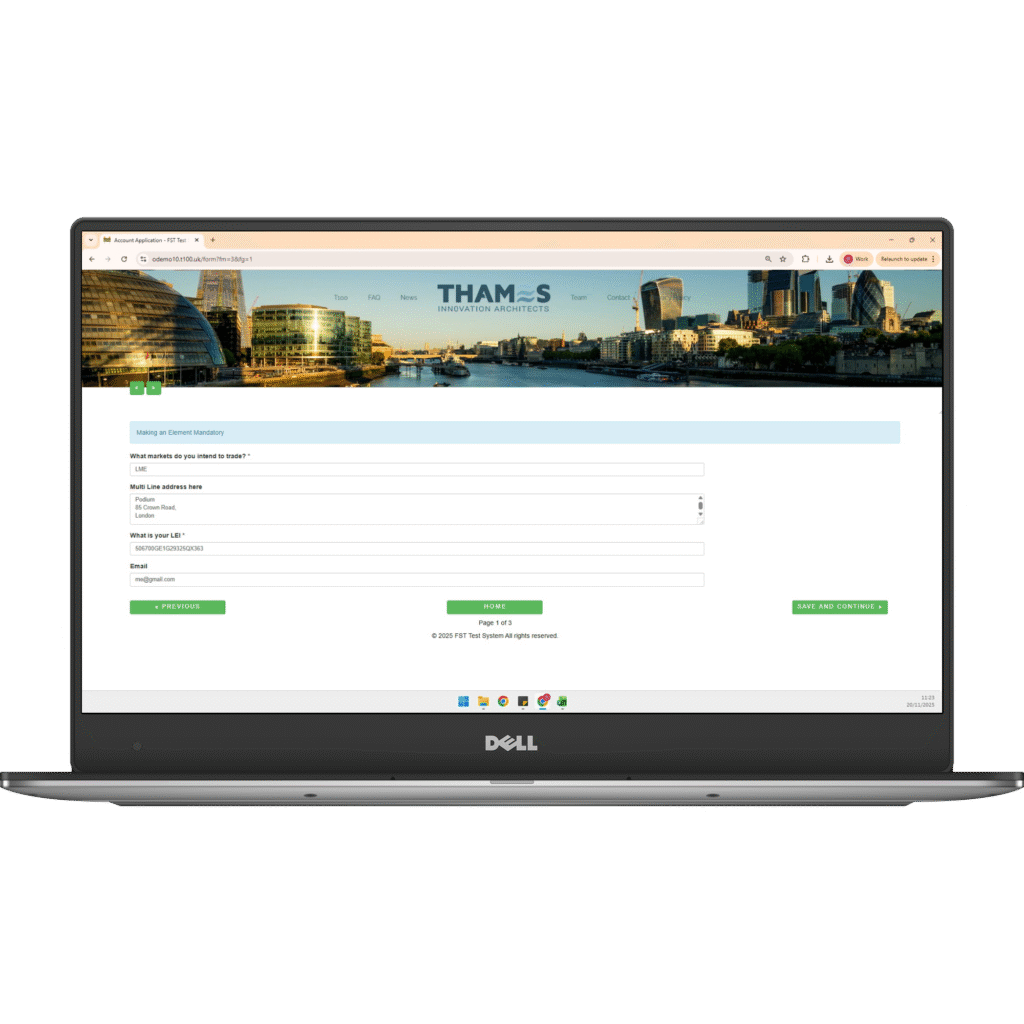

Clients complete fully customisable electronic forms and upload documents directly through the portal, eliminating manual data entry.

Real time status tracking

Clients and staff can see the progress of applications, outstanding tasks and approvals via a secure dashboard.

Direct integration with T100 Core

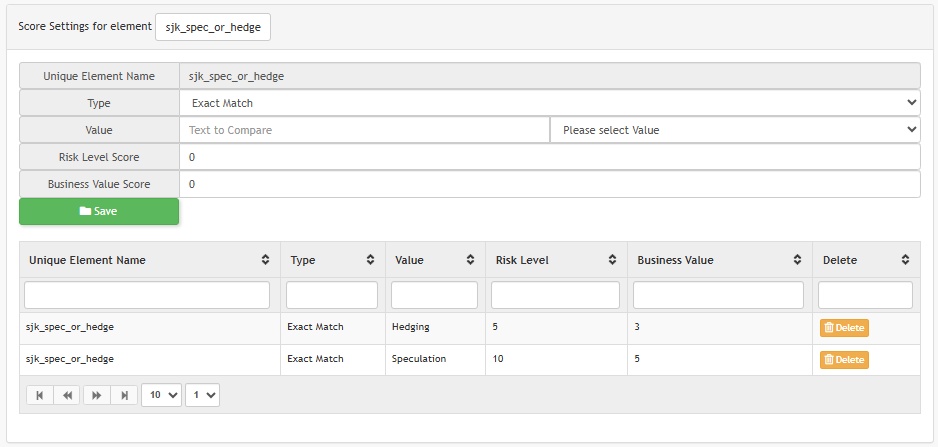

Submitted data flows automatically into the central engine, triggering KYC and AML checks and risk scoring.

Customisable forms and branding

Tailor onboarding forms to suit different client types and maintain your corporate identity.

Multi currency and multilingual support

Serve customers worldwide with ISO 3166 country codes and multiple currency capability.

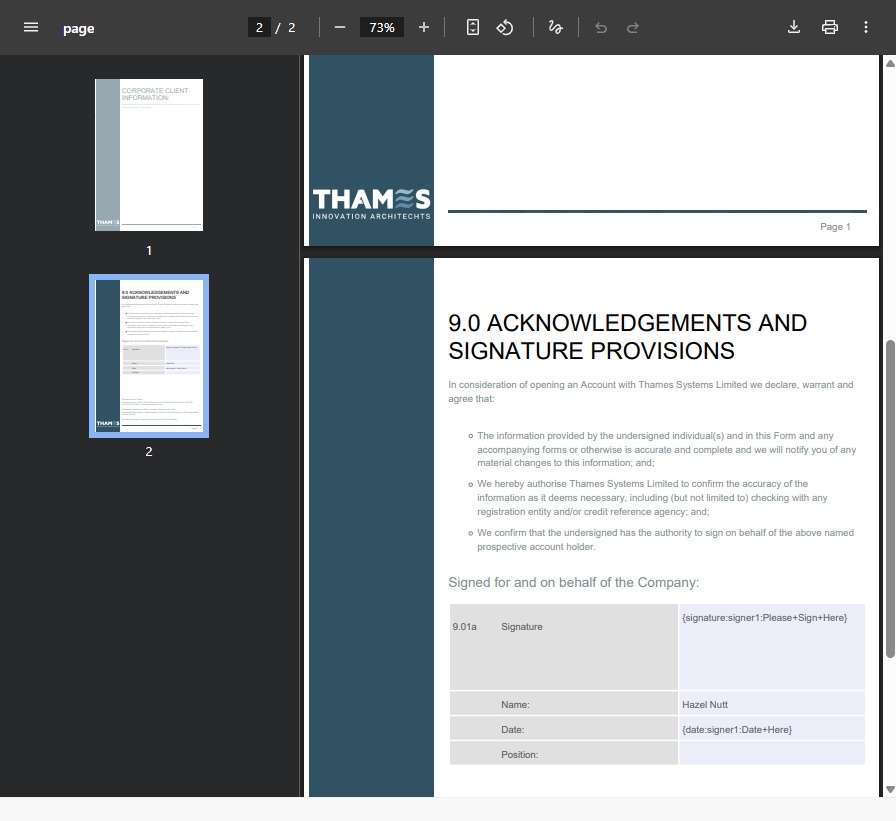

E signatures and document upload

Integrate digital signature providers to streamline agreements and maintain a complete audit trail.

Structured onboarding using form groups and smart logic

A fully integrated onboarding experience for regulated financial firms

Onboarding is organised using a clear hierarchy of form groups, individual forms, pages and questions. This structure allows you to mirror real regulatory workflows rather than forcing everything into a single static application.

Typical FSMA onboarding form groups include:

Entity and registration details

Regulatory permissions and activities

Directors, UBOs and controllers

KYC and AML information

Risk classification and business model

Sanctions, PEP and adverse media declarations

Trading intent, products and markets

Ongoing regulatory disclosures

For FX and payment services firms, onboarding can be simplified while remaining future-proof:

Client and entity identification

Business activity and transaction profile

Source of funds and geographic exposure

Compliance confirmations aligned to FSMA standards

Forms can be invitation-only or publicly accessible depending on your regulatory model, with conditional logic ensuring clients only see questions relevant to them.